.png)

Long Term Care

Planning Guide

Long-Term Care Planning Guide

What is Long-Term Care?

Long term care is a range of services and supports needed to meet personal care needs.

Most long term care is not necessarily medical care, but rather assistance with the basic personal tasks of everyday life, often called Activities of Daily Living

( ADLs); these include:

-

Bathing

-

Dressing

-

Using the toilet

-

Transferring (to or from bed or chair)

-

Caring for incontinence

-

Eating

Information taken from http://longtermcare.gov/the-basics/what-is-long-term-care/

Other common long term care services and supports focus on assisting with daily tasks , often referred to as Instrumental Activities of Daily Living (IADLs) IADLs);

these include:

-

Housework

-

Managing money

-

Taking medication

-

Preparing and cleaning up after meals

-

Shopping for groceries or clothes

-

Using the telephone or other communication devices

-

Caring for pets

-

Responding to emergency alerts such as fire alarms

Who Needs Care?

Factors that influence the Need for LTC

Gender

Disability

Age

Health Status

Living Arrangements

Gender

Women, on average, outlive men by about five years - making them more likely to live at home alone as they grow older.

Living Arrangements

Living alone, as opposed to being married or single and living with a partner, makes you more likely to need paid care

Health Status

Chronic conditions conditions, such as diabetes and high blood pressure pressure, increase the likelihood of you needing care.

Family medical history, such as whether parents or grandparents had

chronic conditions, may increase your likelihood of needing care care.

Poor diet and exercise habits increase your chances of needing long long-term care.

Age

The older you are, the more likely you will need long long-term care.

Disability

Having an accident or chronic

illness that causes a disability

may also result in the need for

long-term care.

On average average, eight percent of people between the ages of 40 and 50 have a disability that could require long long-term care services.

69 percent of people age 90 or

more have a disability.

Information taken from http://longtermcare.gov/the-basics/who-needs-care/

The Odds

Calculating the Need

The duration and level of long long-term care will vary from person to person and often change over time . Here are some statistics (all are “on average”) you should consider:

-

Someone turning age 65 today has a nearly 70% chance of needing some type of long long-term care services and provisions in the future future.

-

Women need care longer than men ( 3.7 years for women as opposed to 2.2 years for men men).

-

One-third of today’s 65 year year-olds may never need long long-term care support, however, 20 percent will need it for longer than 5 years.

Information taken from http://longtermcare.gov/the-basics/how-much-care-will-you-need/

Long-Term Care Services typically come from:

-

A family member or friend who acts as an unpaid caregiver

-

A nurse, home health aide, or therapist who comes to the home

-

Adult day service centers

-

Nursing Homes and Assisted Living Facilities

Information on caregivers shows that:

-

About 80 percent of care at home is provided by unpaid caregivers, such

as family or friends. On average, caregivers spend 20 hours a week giving

care. More than half (58 percent) have intensive caregiving responsibilities,

such as assisting with personal care activities (i.e. bathing or feeding).

-

About two two-thirds of caregivers are women.

-

14% of those who care for older adults are themselves age 65 or older.

Long-Term Care Planning Guide

What does Health Insurance

and Public programs cover?

Medicare

Only pays for long-term care if you require skilled services or rehabilitative care:

-

In a nursing home for a maximum of 100 days; however, the average Medicare covered stay of 22 days is much shorter.

-

At home if you are also receiving skilled home health or other skilled in-home services. Generally, these long-term care services are provided for only a short period of time.

-

Does not pay for non-skilled assistance with Activities of Daily Living (ADL), which make up the majority of long-term care services.

-

You will have to personally pay for long-term care services that are not covered by a public or private insurance program.

Medicaid

-

Does pay for the largest share of long-term care services, but, to qualify, your income must be below a certain level and you must meet minimum state eligibility requirements.

-

Such requirements are based on the amount of assistance you need with ADL.

-

Other federal programs, such as the Older Americans Act and the Department of Veterans Affairs, pay for long-term care services, but only for specific populations and in specific circumstances.

Information taken from http://longtermcare.gov/the-basics/who-pays-for-long-term-care/

Health Insurance

-

Most employer-sponsored or private health insurance, including health insurance plans, cover only the same kinds of limited services as Medicare.

-

If they do cover long-term care, it is typically only for skilled, short-term, medically-necessary care.

How Much Does Long-Term Care Cost?

Click HERE to view Genworth's Cost of Care Survey - a free, online Long-Term Care calculator designed to help you see a rough estimate of how much Long-Term Care might cost in your state.

Genworth 2020 Cost of Care Survey, conducted by CareScout®, August 2020

1 Based on annual rate divided by 12 months

2 As reported, private, one bedroom

Long-term care insurance policies can be used to pay for some, or all of the expenses associated with long-term care services. Most policies will reimburse you for expenses incurred from Home Health Services, Assisted Living Facilities, or Skilled Nursing Facilities. Some Long-Term Care policies allow for family members to provide care for you while others will NOT pay for family members to care for you, but instead require that a licensed caregiver provide the services.

To receive benefits from your policy, you must be unable to perform 2 of the 6 activities of daily living as certified by a physician for a period of least 90 days OR suffer from a severe cognitive impairment that requires you to have substantial supervision for the safety of yourself or others.

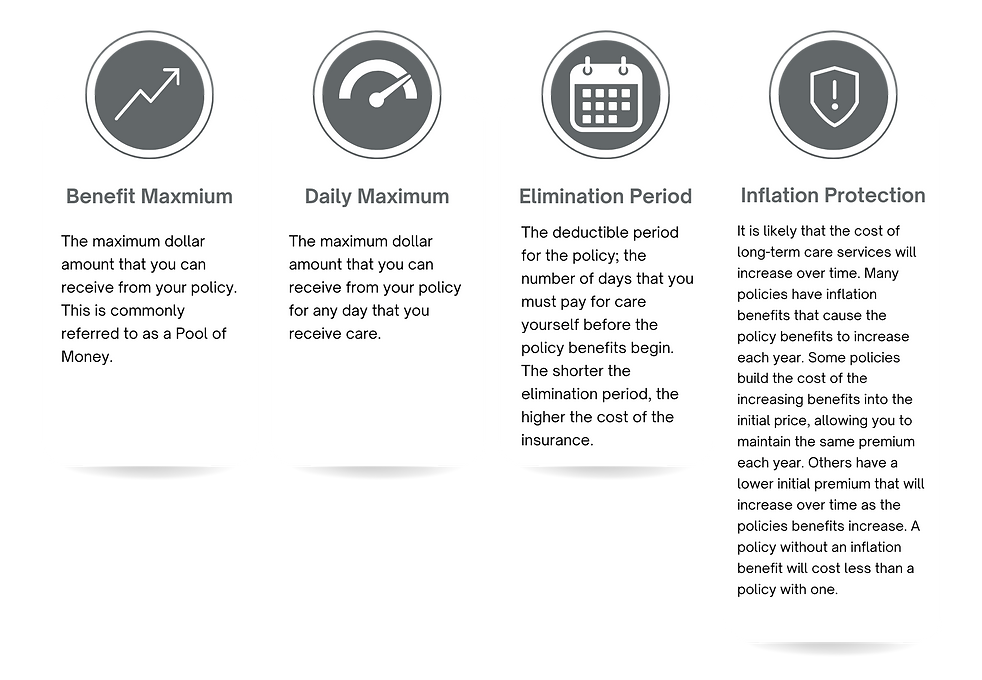

.png)

Types of Long-Term Care Insurance Policies

Traditional Long-Term Care Insurance: These policies are purchased exclusively to cover costs associated with long-term care services. These are typically the least expensive policies to provide protection against long-term care costs. The premium of these policies may increase in the future if the insurance company experiences higher than anticipated claims, or has poor financial performance; however, any premium increase must be approved by the State Department of Insurance and cannot target a specific policy owner, but instead has to apply to everyone who bought that particular product.

Combination Products: These policies are most often either Life Insurance or Annuity policies that allow the insured, if qualified, to access policy benefits for long- term care services. These are commonly purchased with a single, lump-sum payment and are typically guaranteed to not have a premium increase.

Factors that Impact the Price of

Long-Term Care

Example 1 Anna

Anna’s health has declined over the past few years to the point where she has trouble taking care of herself the way she once had. She now lives with her daughter, Gabrielle, and her family.

Gabrielle is a property manager and has to be at the office Monday through Friday during typical work hours. To care for her mother while she is at work, Gabrielle has hired a Home Health Aide to come to their house.

Anna is unable to safely dress or bathe herself, and, because she cannot perform 2 of the 6 Activities of Daily Living (ADL’s), qualifies to receive benefits from her long-term care insurance policy. Gabrielle has the Home Health Aide come to the house for 6 hours a day, 5 days a week. The monthly cost for the Home Health Aide is $2,160.

Anna’s long-term care policy allows her to be reimbursed for up to $3,000 a month of qualified long-term care expenses – which is more than enough to cover the entire cost of the Home Health Aide. Her policy has a maximum policy benefit of $108,000, meaning it will cover the cost of the Home Health Aide for up to 50 months.

Example 2 Jonathan

Mary Beth started to notice that her husband, Jonathan, was having memory problems about a year ago. He would forget things they had recently done and seemed to be having trouble remembering how to do a lot of the household handy work he had always took pride in doing himself. Jonathan was evaluated by his doctor and subsequently diagnosed with having the early stages of Alzheimer’s disease.

The effects were relatively minimal for a while; Mary Beth was able to pick up the slack around the house and be sure that Jonathan was well taken care of. However, as the memory loss progressed, Jonathan needed more help and became increasingly resentful of Mary Beth reminding him to do basic tasks, such as eating, bathing, and taking his medication. In the midst of this tension, Jonathan’s doctor informed them that Jonathan’s Alzheimer’s had become severe and that he would require significant supervision for his safety. It was then that Mary Beth realized that she would need help.

Mary Beth hired a Home Health Aide to come to their house for 4 hours a day, 6 days a week to help Jonathan get dressed, bathe, take his medication, and eat. The Home Health Aide cost $1,728 a month. Jonathan’s long-term care insurance policy, however, would pay for up to $6,000 a month, and was more than enough to pay for his care. The combination of the assistance provided by the Home Health Aide and Mary Beth was sufficient to care for Jonathan for the next 7 months, but, as the disease progressed, it became clear that he was going to need full-time, skilled assistance at a memory care facility.

Fortunately for Mary Beth and Jonathan, there was a skilled nursing facility just a few miles from their home, making it convenient for them to spend time together daily. The cost of the facility was $8,550 per month. $6,000 per month of this cost was covered by Jonathan’s long- term care insurance policy; another $1,400 was covered by his monthly social security benefit. Mary Beth paid the remaining $1,150 per month using their retirement savings.

Interested in Long-Term Care Insurance?

Here are the next steps:

-

If you are interested in getting a quote for long-term care insurance, please complete the next two pages, “Long-Term Care Quote Request Form” and “Quote Request Health Questionnaire”.

-

Your LTC advisor has a variety of LTC insurance solutions. Understanding what is most important to you will help them put together the best options to fit your needs and budget.

-

Insurance companies will extensively evaluate the health of any prospective customer by collecting medical information from a number of sources. These sources vary by company, product, and age - and can include (but are not limited to) health questions on the application, telephone interviews, face-to-face interviews, paramed exams, blood and urine lab testing, pharmaceutical database, MIB, Motor Vehicle Reports, and medical records from the prospective customer’s physicians. The more information you are able to provide to us about your medical history, the better we will be able to provide accurate quotes and recommend the company (or companies) that will give you the most favorable pricing.

CONTACT

Questions?

12400 Coit Rd, Suite 1100

Dallas, TX 75251

972-419-7500

Monday – Friday: 7:45am – 4:30pm